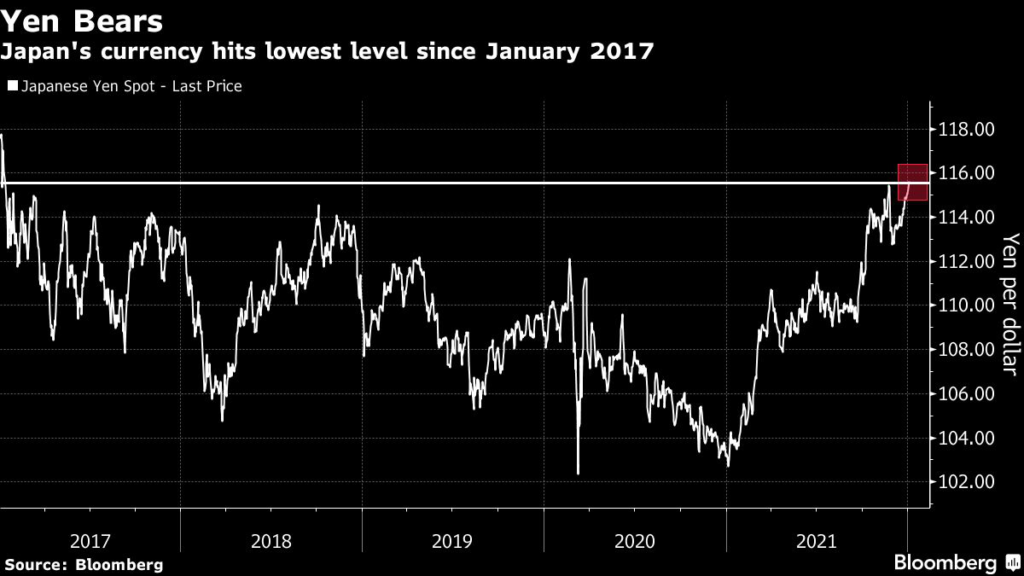

(Bloomberg) — The yen fell to its weakest level against the dollar in five years, as global growth optimism triggered a spike in U.S. Treasury yields and undermined the appeal of safe haven assets.

Japan’s currency dropped as much as 0.4% against the dollar to 115.82 on Tuesday, the lowest since January 2017. It follows a 10% slump last year, its biggest annual drop in seven years.

“The transition to a more normal global economy in 2022 will lead to a normalization of monetary policy by several central banks, including the Fed” and that will weigh on the yen, said David Forrester, senior FX strategist at Credit Agricole CIB in Hong Kong. “We forecast dollar-yen to reach 118 by mid-2022.”

Investors have sold the yen amid soaring Treasury yields and bets on hikes in U.S. interest rates. Funds from Morgan Stanley to JPMorgan Asset Management have advocated selling the Japanese currency against the dollar as the policy divergence between the Federal Reserve and a dovish Bank of Japan grows.

Treasury 10-year yields surged 12 basis points on Monday to close at 1.63%.

Yen Bears

Other strategists are also predicting more yen losses ahead as Japan’s central bank peers mull rate hikes to counter inflationary pressures.

The yen could slide to as low as 119 per dollar by the fourth quarter, according to Mizuho Bank Ltd. BNP Paribas SA and Commerzbank AG see the currency touching 118 in the same period, Bloomberg data show.

“Considering the combination of higher stocks and Treasury yields, the current dollar-yen looks undervalued,” said Hiroyuki Machida, director of Japan FX and commodities sales at Australia & New Zealand Banking Group Ltd. in Tokyo.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.