(Bloomberg) — U.S. index futures and European stocks rose, extending a strong start to 2022, as investors bet data on U.S. manufacturing and job openings will further show the world’s largest economy is resilient against the spread of omicron.

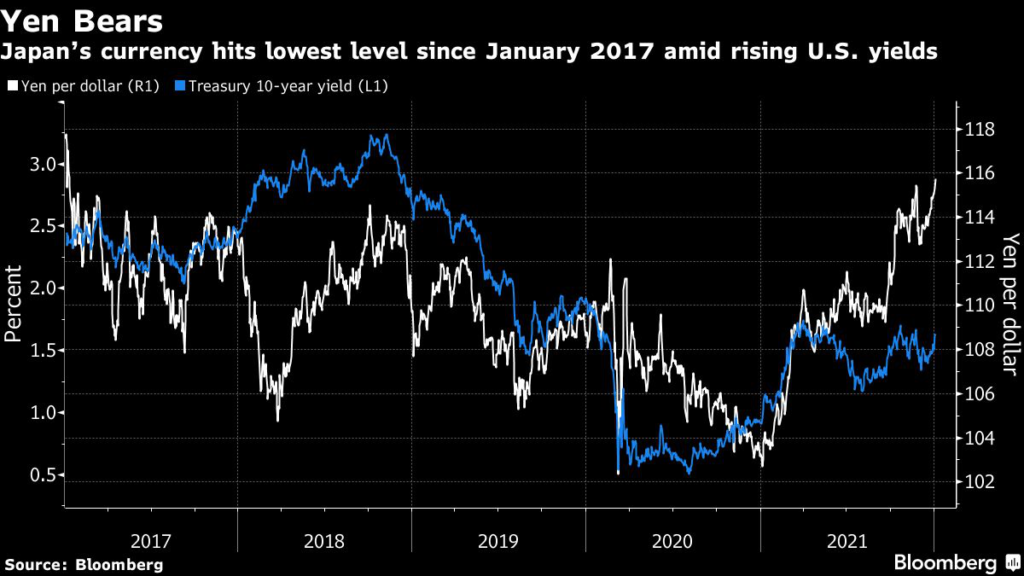

Contracts on the S&P 500 Index climbed 0.4% after the underlying gauge hit another record Monday. Carnival Corp. advanced in premarket New York trading amid a global rebound in travel stocks. Waning demand for haven assets pushed the yen to a five-year low. Treasury yields steadied as Federal Reserve tightening underpinned traders’ debates on the year’s outlook.

Investors are setting aside their worries about the highly infectious omicron virus variant for the moment as they continue to trade on the economic recovery from the pandemic. The ISM December survey, due for release Tuesday, will show the early impact of the variant on supply chains, while the JOLTS data will show the balance between job openings and unemployment numbers.

“Globally, there is a lot of news regarding the rising omicron cases, but there is also a lot of news that the cases are not as deadly as the previous variants of Covid,” Ipek Ozkardeskaya, a senior analyst at Swissquote, wrote in a note. “And investors prefer focusing on a glass half full rather than a glass half empty at the start of the year.”

Markets anticipate an uptick in volatility as they navigate through the omicron variant, supply-chain disruptions and more central banks winding back pandemic stimulus. More than one million people in the U.S. were diagnosed with Covid-19 on Monday, a new global daily record.

The 10-year Treasury yield was steady at 1.63% after surging 12 basis points on Monday. The two-year rate was at 0.77%. Looking beyond the current risk-on momentum, traders expect Fed tightening to boost yields and reset equity valuations. This week’s U.S. December payroll data and minutes from the Fed’s meeting last month may throw more light on the pace of such shift.

“We expect 2022 to be far more challenging from an investment perspective,” Heather Wald, vice president at Bel Air Investment Advisors, said in an emailed note. “Rarely has a market delivered three consecutive years of double-digit returns, as we have seen from 2019-2021. With the Federal Reserve set to accelerate tightening and a fairly valued stock market, we anticipate more muted returns for the S&P next year but still expect equities to remain attractive versus other liquid asset classes.”

Carnival rose 2.6% in early trading, signaling the stock may extend its recovery from last week’s slump on the back of a warning from the Centers for Disease Control and Prevention that even vaccinated travelers must avoid cruises. General Electric Co. rose after the stock was raised to outperform at Credit Suisse Group Inc. and Hewlett Packard Enterprise Co. climbed with an overweight rating from Barclays Plc.

Europe’s equity benchmark recaptured its record level as U.K. airline stocks rallied. British Airways owner IAG, Ryanair Holdings Plc and Wizz Air Holdings Plc advanced at least 10% each as the London market reopened after a holiday and signs grew demand for travel remains robust.

The dollar advanced for a second day, aided by a drop in the yen. Japan’s currency traded weaker than 116 per dollar for the first time since January 2017.

In China, renewable energy and health-care firms paced declines. Also souring the mood, the People Bank of China cut its net injection of short-term cash to the markets, prompting concerns over support for the financial system.

Elsewhere, crude oil futures rose ahead of an OPEC+ meeting on Tuesday to discuss production. Bitcoin hovered around $46,500.

What to watch this week:

- FOMC meeting minutes scheduled for release Wednesday

- Fed’s Bullard discusses the U.S. economy and monetary policy in an event on Thursday

- Fed’s Daly discusses monetary policy on a panel Friday

- ECB’s Schnabel speaks on a panel Saturday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 rose 0.4% as of 6:41 a.m. New York time

- Futures on the Nasdaq 100 rose 0.4%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 rose 0.9%

- The MSCI World index rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.2%

- The euro fell 0.1% to $1.1283

- The British pound rose 0.1% to $1.3497

- The Japanese yen fell 0.7% to 116.14 per dollar

Bonds

- The yield on 10-year Treasuries advanced one basis point to 1.64%

- Germany’s 10-year yield declined two basis points to -0.13%

- Britain’s 10-year yield advanced eight basis points to 1.05%

Commodities

- West Texas Intermediate crude rose 0.5% to $76.49 a barrel

- Gold futures rose 0.2% to $1,803.30 an ounce

(Corrects spelling of CDC in fourth paragraph below chart)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.