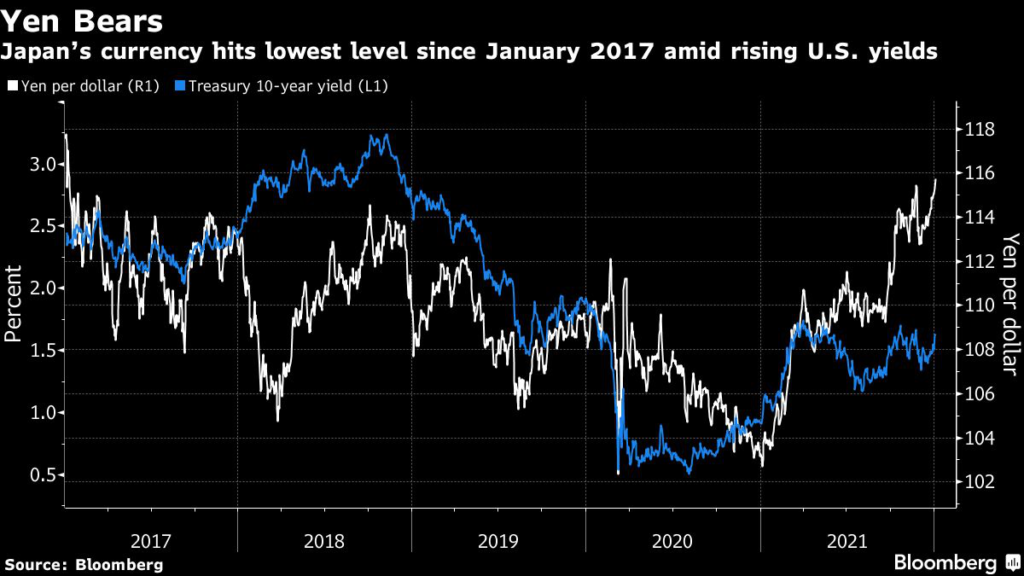

(Bloomberg) — Asian stocks and U.S. futures rose Tuesday in a choppy session as investors assessed the impact of omicron on the outlook for 2022. The yen fell to its weakest since 2017 against the dollar.

Japan and Australia advanced as they reopened after the holiday. A decline in technology stocks weighed on Hong Kong, and Chinese shares stumbled in their first session of the year. The S&P 500 ended at a record even as trading volumes remained light. European futures climbed.

Benchmark Treasury yields steadied after climbing across the curve. The yield on the 10-year note topped 1.60% in its worst start to a year since 2009 as investors braced for Federal Reserve interest-rate hikes in 2022. The yen slid against all its Group-of-10 peers and declined to as low as 115.82 against the dollar.

Markets are anticipating an uptick in volatility. Investors are navigating headwinds from the omicron variant, supply-chain disruptions and more central banks winding back pandemic stimulus that propelled a third year of double-digit returns for equities. More than one million people in the U.S. were diagnosed with Covid-19 on Monday, a new global daily record.

U.S. December payroll data and minutes from the Fed’s meeting last month later this week may build a case for tightening to begin sooner.

“We expect 2022 to be far more challenging from an investment perspective,” Heather Wald, vice president at Bel Air Investment Advisors, said in an emailed note. “Rarely has a market delivered three consecutive years of double-digit returns, as we have seen from 2019-2021. With the Federal Reserve set to accelerate tightening and a fairly valued stock market, we anticipate more muted returns for the S&P next year but still expect equities to remain attractive versus other liquid asset classes.”

In China, renewable energy and health-care firms paced declines. Also souring the mood, the People Bank of China cut its net injection of short-term cash to the markets, prompting concerns over support for the financial system.

“There looks to be more of the same thing that happened last year — institutional money is moving out of the hottest stocks because the positives have been largely priced in,” Gao Shan, chief investment officer at Shanghai Universal Wisdom Fund Ltd., said.

Elsewhere, crude oil in New York fluctuated ahead of an OPEC+ meeting on Tuesday to discuss production. Bitcoin hovered around $46,000.

What to watch this week:

- FOMC meeting minutes scheduled for release Wednesday

- Fed’s Bullard discusses the U.S. economy and monetary policy in an event on Thursday

- Fed’s Daly discusses monetary policy on a panel Friday

- ECB’s Schnabel speaks on a panel Saturday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.2% as of 7:14 a.m. in London. The S&P 500 rose 0.6%

- Nasdaq 100 futures rose 0.3%. The Nasdaq 100 rose 1.1%

- Topix index rose 1.9%

- Australia’s S&P/ASX 200 Index advanced 2%

- Kospi index was little changed

- Hang Seng Index declined 0.3%

- Shanghai Composite Index fell 0.2%

- Euro Stoxx 50 futures rose 0.4%

Currencies

- The Japanese yen was at 115.72 per dollar, down 0.4%

- The offshore yuan was at 6.3800 per dollar

- The Bloomberg Dollar Spot Index gained 0.1%

- The euro traded at $1.1287

Bonds

- The yield on 10-year Treasuries held at 1.62%

- Australia’s 10-year bond yield increased eight basis points to 1.75%

Commodities

- West Texas Intermediate crude dropped 0.4% to $75.79 a barrel

- Gold was at $1,805.04 an ounce, up 0.2%

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.